|

|

Year End Tax Tips to Trim Your 2013 Taxes

Unless Congress intervenes, the Bush-era tax cuts expire when 2013 arrives. Also at risk if lawmakers don’t act before Dec. 31st are many popular tax breaks that expired at the end of 2011 that have long been considered sure-shots for revival. Those breaks include the authority to make direct contributions from traditional IRAs to charity.

Unless Congress intervenes, the Bush-era tax cuts expire when 2013 arrives. Also at risk if lawmakers don’t act before Dec. 31st are many popular tax breaks that expired at the end of 2011 that have long been considered sure-shots for revival. Those breaks include the authority to make direct contributions from traditional IRAs to charity.

Many believe Congress will extend current tax rates, at least temporarily, and probably for all taxpayers.

There are some year-end things you can do to trim your 2012 tax liability. Let’s review them briefly:

Prepare For a New Surtax – One of the biggest changes on the books for 2013 is a 3.8% surtax on investment income for married couples with modified AGI of more than $250,000 (singles, $200,000). As part of the new health care law, the tax applies to the smaller of net investment income or the amount by which taxable income exceeds the thresholds. Investment income includes dividends, interest, capital gains, annuities, royalties and rents. Investment income does not include distributions from IRAs or other retirement accounts.

To lower the potential tax bite, you could give away income-producing assets, such as stocks or investment property, to adult children whose income is far below the threshold. They would not be affected by that extra tax. This is a particularly good year to make large gifts because of a change in the federal gift tax law.

You could also consider accelerating plans to convert part of your traditional IRA to a Roth. Although IRA distributions are not investment income under the surtax law, they could boost your taxable income above the threshold to make otherwise protected investment income vulnerable. Plus, because tax-free Roth distributions are not included in AGI, they would not count toward the surtax threshold in future years.

Unless Congress intervenes, this will be the last year that taxpayers who are in the 10% and 15% tax brackets — joint filers with taxable incomes up to $70,700 and individuals with incomes up to $35,350 — can enjoy a 0% tax rate on long-term capital gains. However, the 0% rate only applies until your income breaks through the 15% ceiling. If you’re a married couple with income of $60,000 and sell a stock for a profit of $20,700, you’ll pay 15% capital-gains tax on $10,000.

Congress has yet to extend a tax break that enables IRA owners who are 70 and a half or older to send a tax-free distribution of up to $100,000 directly to charity. Don’t wait past mid December to direct your IRA custodian to withdraw your minimum distribution.

Give, and You’ll Receive a Break – No matter what happens with the federal estate tax next year, you can still give an unlimited number of individuals up to $13,000 each this year without worrying about federal gift tax. Your spouse can give another $13,000 each to the same people. Higher-income parents could consider giving appreciated stock to adult children in the 0% capital-gains bracket. An adult child in a lower bracket would pay a lot less in capital gains on a sale than if you sold the stock.

If you are considering giving away a vacation home, business interests or appreciating stock, this may be the time to do it either directly or through a trust. See an estate-planning lawyer for advice. The lifetime gift-tax exemption may never be this high again.

Boost Medical Expenses – Under the health care law, there’s a higher hurdle between you and medical expense deductions starting in 2013. Currently, write-offs are permitted only to the extent your qualifying bills exceed 7.5% of your adjusted gross income. Next year, the threshold rises to 10%. However, for the 2013 to 2016 tax years, the 7.5% threshold applies if either spouse turns 65 before the end of the year.

Consider accelerating the timing of planned elective surgery, dental work or other medical procedures. If you have the option to get some procedures done now, you may want to take care of those things before the year ends. Other expenses that could push you above the threshold: the cost of transportation to a medical facility and certain medically related home improvements.

As always, tax laws seem to be ever-changing, so it is advisable to consult a tax attorney or CPA before making any major changes in your tax filing status, or taking action that could affect your withholding.

.

Housing In Midst of Recovery

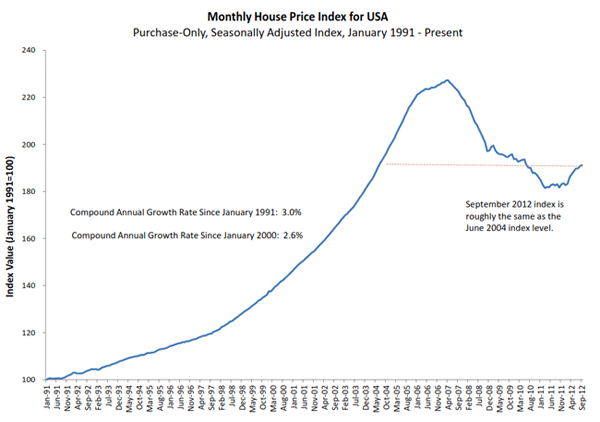

U.S. home prices rose in September for the sixth straight month, signaling that the housing market is “in the midst of a recovery,” according to the S&P/Case-Shiller home-price index released recently.

U.S. home prices rose in September for the sixth straight month, signaling that the housing market is “in the midst of a recovery,” according to the S&P/Case-Shiller home-price index released recently.

The S&P/Case-Shiller 20-city composite posted a non-seasonally adjusted 0.3% increase in September to reach the highest level in two years, following a 0.8% gain in August. Home prices were up 3% from September 2011 for the largest annual percentage growth since July 2010.

This most recent report on home prices is the latest news on a strengthening housing market. There have also been recent gains in new construction, home-builder sentiment, and existing-home sales. This latest report points to a housing market in which excessive inventory is tapering off and there is increasing demand.

However, there are still concerns about shadow inventory. Also, while persistently low mortgage rates are attracting some buyers, consumers still face tight credit standards, and officials say factors such as tight lending terms will likely block a powerful housing recovery. Indeed, despite recent gains, prices are about 30% below peak levels in 2006, according to Case-Shiller data.

.

Home Prices at June 2004 Levels

The Federal Housing Finance Agency (FHFA) has released its House Price Index (HPI) for August which shows a 0.7 percent increase in prices compared to July. For the 12 months ending in August, U.S. prices rose 4.7 percent. July figures were revised downward in the report from a 0.2 percent increase to 0.1.

Home prices nationally are now at approximately the same level as in June 2004 and are 15.9 percent below the peak in prices reached in April 2007. FHFA’s bases its index on the purchase price of houses with mortgages owned or guaranteed by Fannie Mae or Freddie Mac.

For the nine census divisions, seasonally adjusted monthly price changes from July to August ranged from -0.5 percent in the East South Central division to +3.0 percent in the Pacific division, while the 12-month changes ranged from 0.4 percent in the Middle Atlantic division to +11.4 percent in the Mountain division.